Some Known Incorrect Statements About Life Insurance Company

Table of ContentsLife Insurance Quote Online Things To Know Before You Buy

depends upon your specific demands. A term life plan makes good sense if you think you just will require protection for a period. Term life also tends to be more budget-friendly than entire life, so it can make feeling for those concentrated on remaining within a spending plan. "Term insurance coverage is good for a person who has an insurance coverage demand for only an established number of years,"says Jason Wellmann, elderly vice president of life circulation at Allianz Life.

Whole life insurance policy additionally makes sense for those that wish to secure one exceptional price and preserve that cost for as long as they live."The survivor benefit stays in area for the entire lifetime of the insured, as long as enough costs are paid, "Wellmann states. Whole life additionally offers a" cash value"account that attract those wanting to accumulate a bigger swimming pool of financial savings. You can access money value in the form of a loan or withdrawal from the cash money value. The money could be used for points such as: Assisting with a youngster's college education, Financing retirement earnings, Spending for emergency expenditures, Just how to choose a life insurance policy coverage amount? You may question,"Just how much life insurance policy do

I need?" When acquiring life insurance coverage, picking the ideal quantity can be tough. Some professionals recommend buying an advantage that will pay seven to 10 times an insurance holder's yearly revenue. Working carefully with a life insurance representative can assist you figure out just how much protection you require given your special circumstance. Term life insurance Louisville. Just how much does life insurance policy cost?Average life insurance coverage price is a little bit of a misnomer because the cost of a life insurance plan can differ extensively by person. Females live much longer, so they have a tendency to pay lower premiums. Healthier individuals pay lower premiums than those with some clinical conditions. You will pay higher premiums if you smoke. People with risky pastimes-- such as sky diving-- may pay greater costs. Jobs that include even more physical threats can cause greater costs. If you're looking for affordable life insurance coverage, understand that term life protection is

usually normally less costly whole life coverageInstance How to conserve on life insurance policy? The most effective life insurance policy is the one that Visit This Link fully fulfills your demands. Buying life insurance policy is constantly a balancing act between obtaining the coverage you require and getting the best life insurance coverage prices."Identify what is very important to your economic plan as well as evaluate each year."Another vital method to conserve is to contrast life insurance policy rates. By doing this, you can discover the most effective plan at the most effective rate. How to obtain life insurance policy quotes? You have several alternatives for obtaining life insurance policy quotes. One method is to narrow a checklist to a number of insurance providers as well as to obtain specific quotes from each of them, either by calling their offices or utilizing their internet site

. Getting life insurance policy estimates online is among the very best methods to conserve. One of the easiest and quickest means to gather quotes is to use a service like the one used by Simply enter your postal code and you will rapidly get numerous life insurance policy estimates in simply a couple of mins. Below are some questions to answer: Do you have liked ones depending upon your revenue for their health? Exists a preferred charity or cause you want to support economically? Do you intend to provide money to cover your final costs? Relying on your objectives, you may designate one or more individuals to be recipients. Alternatives might consist of: All of the fatality benefits arrive in a single repayment (Life insurance companies near me). Some recipients locate it easier to get the cash slowly over a duration. Some insurance companies may permit a recipient to maintain the death benefit

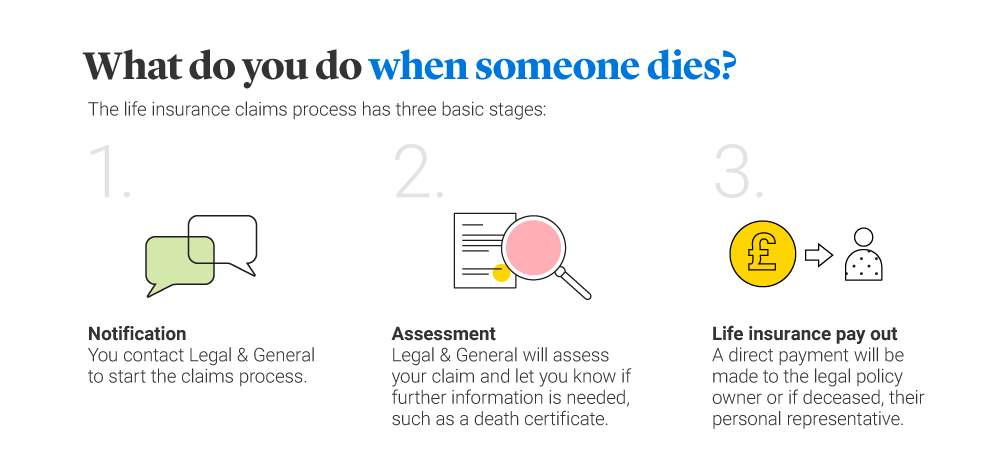

in an interest-bearing account. Beneficiaries can then create checks versus the cash in the account. Unless the annuity is established for a set duration, any type of staying survivor benefit remaining when the beneficiary passes away will certainly go back to the insurer. Term life insurance. Exactly how does a beneficiary make an insurance claim? The Insurance coverage Details Institute suggests